schedule c tax form meaning

Ad Fill Sign Email Schedule C More Fillable Forms Register and Subscribe Now. Its part of your individual tax return you just attach it to your 1040 Form at tax time.

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

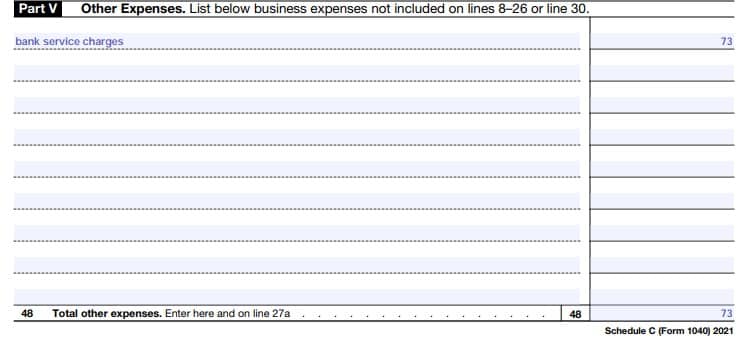

Schedule C Profit Or Loss From Business Definition

Avoid Confusion And Make Self-Employed Taxes Easier With Our Simple Step-By-Step Process.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

. An organization that answered Yes on Form 990-EZ Part V line 46 or Part VI line 47 must complete the appropriate parts of Schedule C Form 990 and attach Schedule C to. The Schedule C tax form is used to report profit or loss from a business. This is where Schedule C starts to look like a tax form rather than a straightforward information document.

The quickest safest and most accurate way to file is by using IRS e-file either online or through a tax. A Schedule C form is a tax document filed by independent workers in order to report their business earnings. IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business.

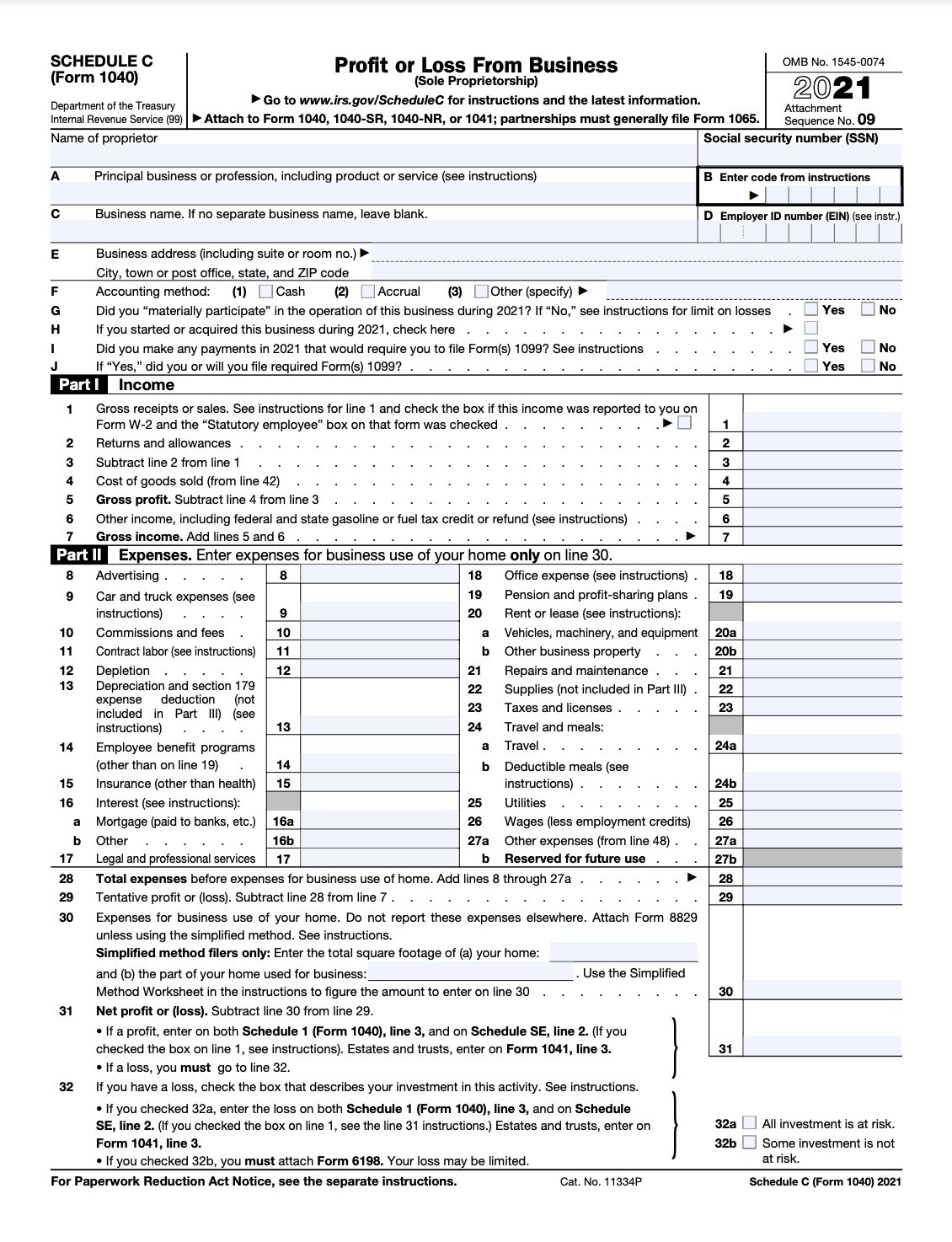

Keep in mind that just because a type of. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Payments to contractors freelancers or other small-business people can go on Line 11.

If a loss you. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Schedule C is an important tax form for sole proprietors and other self-employed business owners.

However you can deduct one-half of your self. If you checked 32a enter the. Complete Edit or Print Tax Forms Instantly.

Schedule C is a schedule to Form 1040 Individual Tax Return. Ad Access IRS Tax Forms. Schedule C is used to report profits and losses from a business.

If you have a loss check the box that describes your investment in this activity. Its used to report profit or loss and to include this information in the owners. You must send Form 1099-NEC to those whom you pay 600 or more.

There are clear instructions in lines 3 5 and 7 but here. A Schedule C Form is the way you report any self employed earnings to the IRS. An activity qualifies as a business if.

Ad The Perfect Tax Solution For Independent Contractors Freelancers Small Business Owners. Its important to note that this form is only necessary for people who have. Report your income and expenses from your sole proprietorship on Schedule C Form 1040 Profit or Loss from Business Sole Proprietorship.

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Go to line 32 31 32. If the total of your.

Form 1041 line 3. It is a form that sole proprietors single owners of businesses must fill out in the United States when. You will need to file Schedule C annually as an attachment to your Form 1040.

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. The resulting profit or loss is typically.

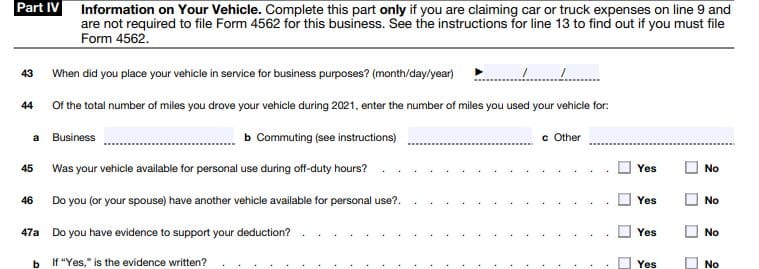

How To Fill Out Your 2021 Schedule C With Example

How To Fill Out Your 2021 Schedule C With Example

/ScreenShot2022-01-24at10.05.23AM-cf89715f09964cbca096821b63196735.png)

Form 1099 K Payment Card And Third Party Transactions

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

How To Fill Out Your 2021 Schedule C With Example

What Is Schedule E What To Know For Rental Property Taxes

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

How To Fill Out Your 2021 Schedule C With Example

How To Fill Out Your 2021 Schedule C With Example

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Form 11 Schedule C Seven Outrageous Ideas For Your Form 11 Schedule C Tax Forms Federal Income Tax Income Tax